Make a Difference

Give a lasting gift that will impact the health of billions.

Support the Food Fortification Initiative (FFI) by giving through Emory University, FFI’s fiscal sponsor. Your gift will allow us to expand the technical assistance we provide to government and industry leaders in their fight against vitamin and mineral deficiencies. Learn more about opportunities to give to support food fortification programs in geographies with the strongest need.

Funding Exception

The blend of vitamins and minerals added to grain products during fortification is called premix. We do not endorse any premix manufacturer. We invite all interested premix companies to sponsor lunches, receptions, or coffee breaks at our events, but to avoid conflicts of interest, we limit annual contributions from premix suppliers. Premix companies are also not represented on the Executive Management Team.

Donor Privacy Policy

FFI is committed to respecting the privacy of donors. The information you provide when you make a gift through Emory University will be used by FFI for the purpose of correctly allocating, crediting, and acknowledging your gift. We will not trade, share, or sell your personal information to any third party. On rare occasions, Emory University may be legally required to disclose information. We subscribe and adhere to the Association of Fundraising Professionals (AFP) Donor Bill of Rights, which you may view online at the AFP website.

Financial Accountability

FFI relies on the financial generosity of individuals, corporations, foundations, and government agencies to help us continue building a smarter, stronger, and healthier future. Accountability and transparency are an important part of our work. Our funding is used to help us efficiently and effectively fulfill our mission.

FFI is a center of the Rollins School of Public Health at Emory University, which contributes office space and administrative support but not core funding to FFI. Emory University, and consequently FFI, is exempt from federal income tax under section 501(a) as an educational institution described in section 501(c)(3) of the Internal Revenue Code. Emory University’s Federal Tax ID (EIN) is 58-0566256. To learn more, see Emory University’s audited financial statements.

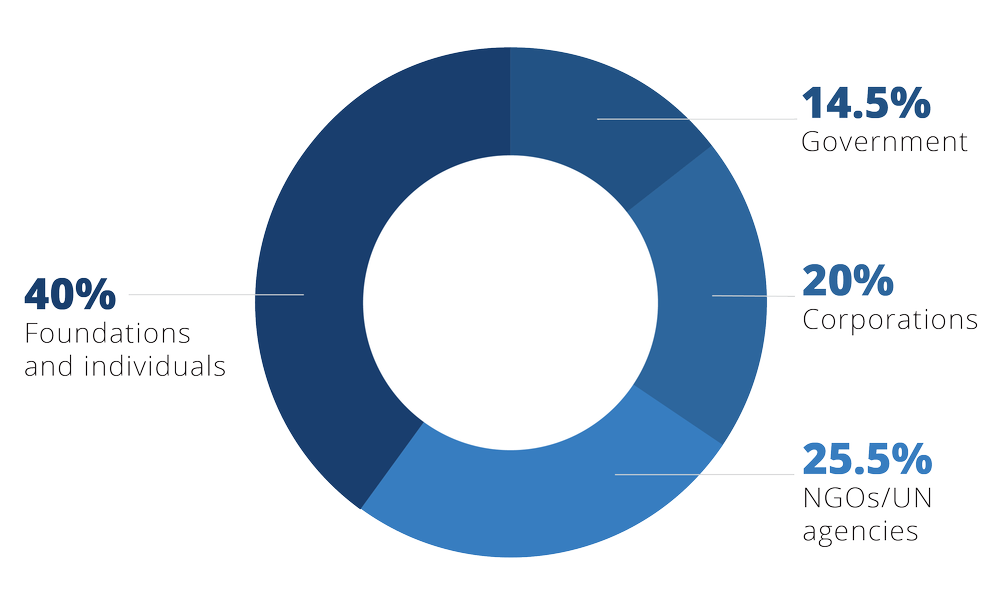

Gift Profile

FFI received US$ 1.2 million in 2022.

To learn more, see FFI’s most recent annual budget.

Ways to Give

Give Online

To make your gift online, visit FFI’s secure giving page through Emory University.

International Wire Transfer

To request banking details for an international wire transfer of funds, contact Scott Montgomery, FFI Director, at sjmontgom@gmail.com or +1-612-834-2012.

By Mail

To send a gift through standard mail, print a gift form, and send it with your check to:

Office of Gift Accounting, Emory University

1762 Clifton Road NE, Suite 1400

By Phone

Call +1-404-712-GIVE (4483) and mention that you’d like to give to the Food Fortification Initiative.

In-Kind

Contact Scott Montgomery, FFI Director, at sjmontgom@gmail.com or +1-612-834-2012.

Electronic Funds Transfer

To support FFI through EFT, simply print the EFT form, fill it out, and send it with a voided check to:

Office of Gift Accounting, Electronic Funds Transfer Administrator, Emory University

1762 Clifton Road NE

Atlanta, GA 30322-4001

Mutual Funds, Stocks, and Securities

To make a one-time gift of mutual fund shares, closely held stock, or other forms of stock, follow these instructions or call the Office of Gift Accounting at +1-404-712-GIVE (4483) for more information.

Visit the Emory University Office of Gift Planning online or call at +1-404-727-8875 for more information.

Donor-Advised Fund

A donor-advised fund (DAF) is a charitable giving program that allows you to combine the most favorable tax benefits with the flexibility to support your favorite causes. DAF Direct enables you to recommend grants to FFI through Emory University from your DAF (as long as your DAF’s sponsoring organization is participating). Using the DAF Direct widget, you can initiate a DAF grant recommendation from our website.

FFI is fiscally sponsored by Emory University, a Georgia nonprofit corporation and a tax-exempt entity under Section 501(c)(3) of the Internal Revenue Code. EIN: 58-0566256

Doubling Your Gift

You may even be able to double or triple the value of your donation if your employer has a matching gift program. You can reach out to one of Emory University’s advancement staff members to discuss giving options, learn more about employer matching, or make a gift.